The News:

The World Inequality Lab has released a working paper titled "Income and Wealth Inequality in India, 1922-2023: The Rise of the Billionaire Raj," which provides a detailed analysis of the trends and dynamics of economic inequality in India over the past century. Here are the key findings and insights from the report:

The paper, which has been co-authored by Nitin Kumar Bharti, Lucas Chancel, Thomas Piketty, and Anmol Somanchi, combines data from national income accounts, wealth aggregates, tax tabulations, rich lists, and surveys on income, consumption, and wealth to arrive at the results.

Key Findings:

- Income Inequality: In 2022-23, the top 1% of the population in India captured 22.6% of the national income, the highest level since 1922. This level of inequality is among the highest in the world, surpassed only by countries like South Africa.

- In other words, states the paper, “the ‘Billionaire Raj’ headed by India’s modern bourgeoisie is now more unequal than the British Raj headed by the colonialist forces”. It also notes: “It is unclear how long such inequality levels can sustain without major social and political upheaval.”

- Wealth Inequality: The top 1% also held 40.1% of the national wealth in 2022-23, marking the highest concentration since 1961. The report highlights that this extreme concentration of wealth at the top has tripled since 1961.

- Historical Trends: The paper documents a significant rise in the number of very high-net-worth individuals since the economic liberalization of the 1990s. From just one billionaire in 1991, India had 162 billionaires by 2022.

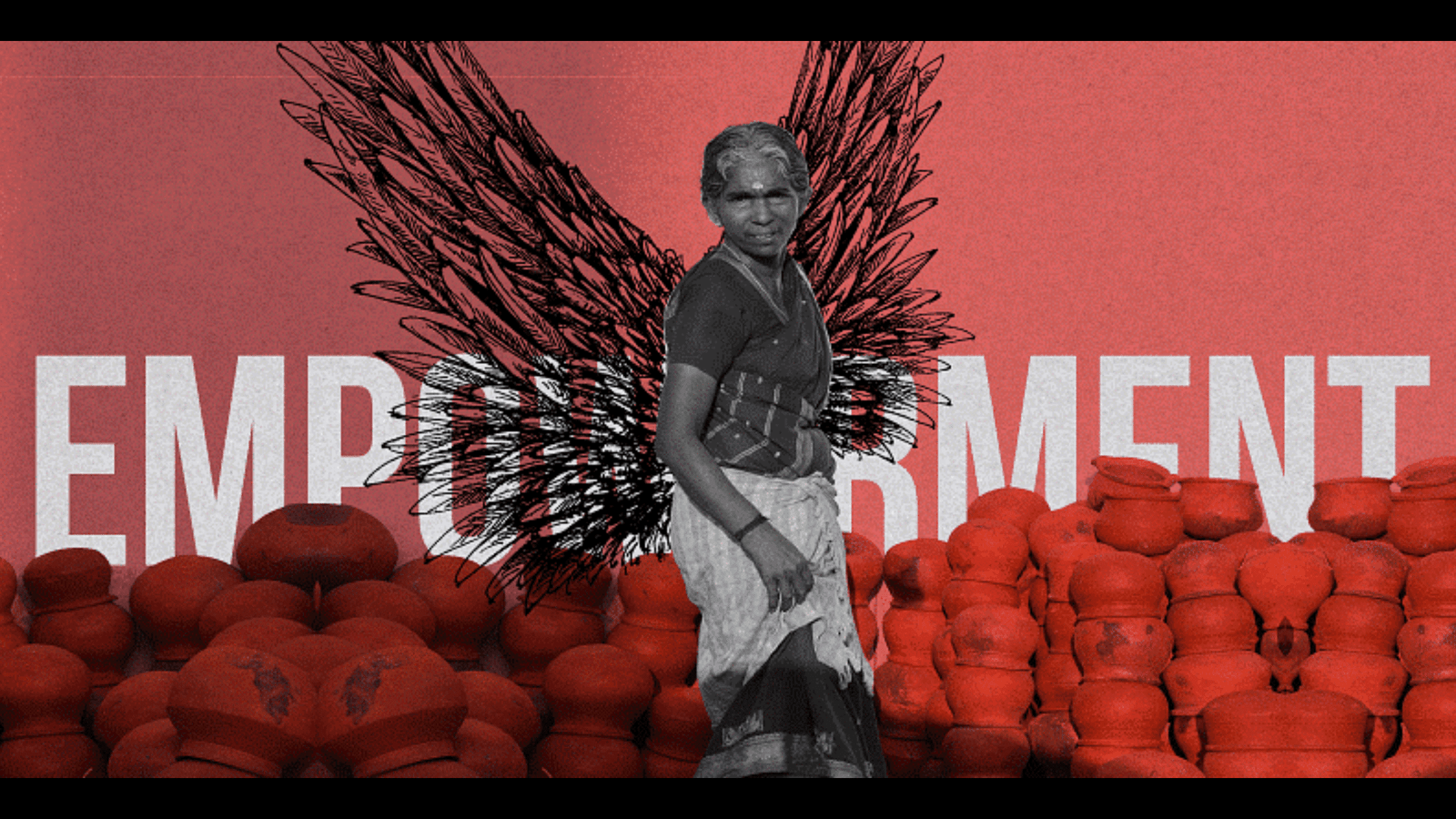

- Gender and Social Disparities: The report also touches on the disparities in wealth distribution among different social groups and genders, noting that marginalized communities and women are disproportionately affected by economic inequality.

- Growth in average incomes: According to the WIL paper, between 1960 and 2022, India’s average income grew at 2.6% per year in real terms (that is, after removing the effect of inflation). This period can be broadly divided into two halves: “Compared to a real growth rate of 1.6% per year between 1960 and 1990, average incomes grew by 3.6% per year between 1990 and 2022”. It further states that the periods 2005-2010 and 2010-2015 saw the fastest growth at 4.3% and 4.9% per year respectively.

- Rise in the percentage of income taxpayers: The paper finds that the share of the adult population that filed an income tax return — which had remained under 1% till the 1990s — also grew significantly with the economic reforms of 1991. By 2011, the share had crossed 5% and the last decade too saw sustained growth with around 9% of adults filing a return in the years 2017-2020.

Sociological Analysis:

- Thomas Piketty, a renowned economist, wrote his seminal book, "Capital in the Twenty-First Century." He introduces the concept of "patrimonial capitalism," where economic elites derive their wealth primarily from inherited assets rather than from entrepreneurial or labour income. This, he argues, leads to a self-reinforcing cycle of inequality.

- Erik Olin Wright was interested in finding ways to reduce income inequality through transformative strategies. He explored various models of social transformation, including Reforms within capitalism (such as social democratic policies), Ruptural transformations (revolutionary changes), and Interstitial transformations (gradual changes through the creation of alternative institutions).

- William Julius Wilson's research highlights the effects of concentrated poverty. He argues that living in high-poverty neighbourhoods has compounding negative effects on residents, including limited access to quality education, social services, and economic opportunities. This concentration of disadvantage exacerbates income inequality and limits social mobility.

- Cultural and Social Isolation: Wilson discusses how economic changes and concentrated poverty contribute to social isolation and the weakening of social networks in urban communities. This isolation can lead to the erosion of social norms and institutions that support upward mobility, further entrenching income inequality.

Way Forward:

To address these rising inequalities, the paper suggests several policy measures, including:

- Super Tax on Wealth: Implementing a super tax on billionaires and multimillionaires.

- Restructuring the Tax Code: To encompass both income and wealth, aiming to make the tax system more progressive.

- Public Investments: Increasing investments in education, health, and public infrastructure to foster more equitable economic development.

The findings underscore the profound socioeconomic disparities that have intensified in recent decades. Addressing these challenges requires comprehensive policy interventions aimed at promoting inclusive growth and social justice in India.